Banking For

Next Generation

Fully Automated Digital Lending Software

Seamless Automation, Seamless Growth

What we do

We Help Our Clients Spread The Lending

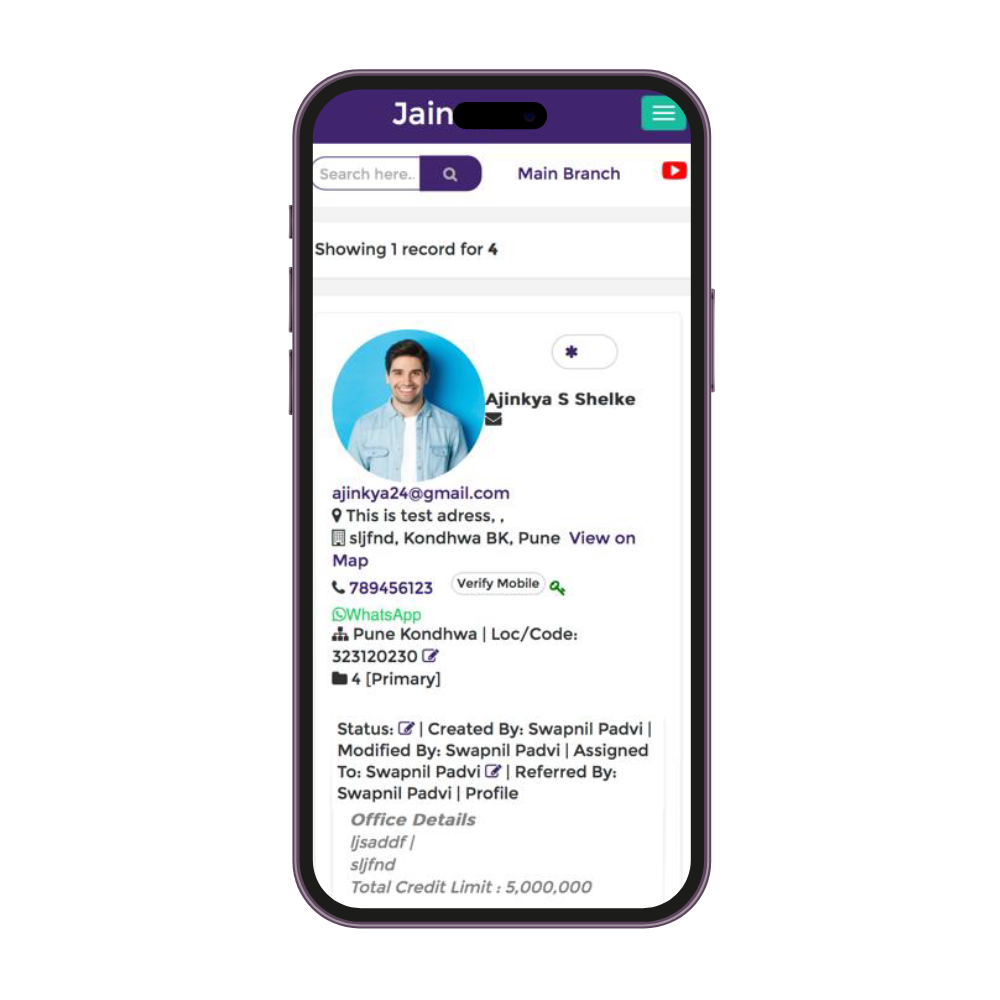

Customer-Centric Solutions for Financiers & Depositors

Put your customers first with our intuitive software that enhances borrower experience and fosters loyalty.

Unleash the Power of Data Driven Decision Making

Harness the full potential of data analytics to make informed lending decisions and stay ahead of the competition.

Scalability Redefined: Grow Your Loan Portfolio with Confidence

Whether you’re a small lender or a large institution, our scalable software adapts to your needs and fuels sustainable growth.

1200+ clients worldwide use our products

Tech-Powered Banking for the Digital Age: Where Innovation Meets Generation Next

Say goodbye to tedious paperwork and manual processes.

Robust Compliance Management

Stay compliant with ever-changing regulatory requirements effortlessly.

Real-Time Analytics:

Gain valuable insights into your NBFC’s performance with real-time analytics and reporting tools.

1200+ clients

Worldwide company

With five years of dedicated service, our NBFC software stands as a testament to our commitment and expertise.

Cities Covered

Recent growth

Some Love From Our Clients

“ Upstart lending financial services operating in Sydney & Fiji. We are proud to be associated with Jainam Software. This is the best customized money lending software that offers cloud based solution that is robust, secure and supportive. ”

Rosie Young

“ We have been with Jainam for a quite long time. We have seen a potential business growth through Jainam’s advanced features. Jainam is a complete solution for LOS. LMS is very nearer to reach its peak.”

Anchal Sood

“Jainam Software has helped us in providing runtime interest calculation as per our business configuration. Jainam’s has helped to go live with the important business rules for penalty calculation. ”

Reginald D. Mutakyava

Steve Jobs

Co-founder of Apple

25+ Partners Worldwide

Achievements & Recognition

Here are some frequently asked questions

What features does your NBFC software offer?

Our NBFC software offers a comprehensive suite of features, including loan origination, credit risk assessment, loan servicing, compliance management, real-time analytics, customer relationship management (CRM), payment gateway integration, eSignature, eStamping, and more.

Is your NBFC software customizable to suit our specific business needs?

Customization options are available to tailor our NBFC software to your specific business requirements. Our IT team will assess the feasibility of requested customizations and discuss potential solutions with you to ensure they align with the software’s capabilities and your organization’s needs.

Is your NBFC software cloud-based or on-premises?

Our NBFC software is cloud-based, offering flexibility for users to access the platform from any device with internet connectivity. This allows for seamless access and collaboration across various locations and devices, enhancing user convenience and productivity.

Do you offer a free trial or demo of your NBFC software?

Yes, we offer a free trial or demo of our NBFC software to allow you to experience its features and functionalities firsthand. Contact us to schedule a demo or request a trial to see how our software can benefit your organization.

Does your NBFC software integrate with payment gateways for easy loan disbursal and repayments?

Yes, our NBFC software seamlessly integrates with leading payment gateways, allowing for secure and convenient loan disbursals and repayments.

Can borrowers make repayments with UPI?

Yes, our NBFC software seamlessly integrates with leading payment gateways, allowing for secure and convenient loan disbursals and repayments.

Useful Articles

From The Blog

-

How to restrict print template access to my staff?

By

In Jainam Software, We can give print template access to the employee according to his need. He can access or see the templates which was given to him. In Master Set Up > Print Template, I have created few templates. In below screen shot you can see the template List. I have created one User…